Facilitating Efficient Producer-Wholesaler Contracts

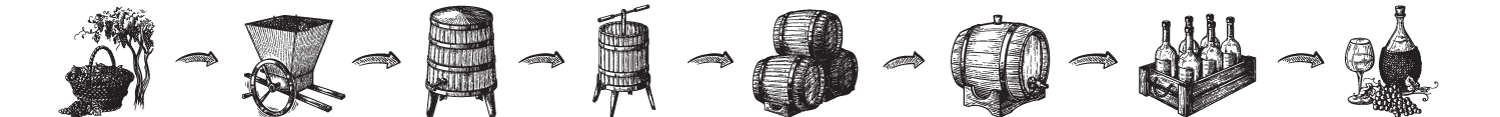

The seasoned business law attorneys at Malkin Law understand that commercial success depends on efficiency and effectiveness along all stages of the supply chain. We are dedicated to facilitating smooth, profitable transactions for clients – while limiting liability exposure and ensuring compliance with the complex network of regulations that govern the distribution of beer, wine and distilled spirits in the United States. With a decade in practice, Malkin Law, P.A.‘s attorneys advise wholesalers in the nuances of licenses and permits and provide team training and trade practice analysis.